In today’s cashless world, accepting credit card payments is essential for any business, whether it’s an online store, a restaurant, or a retail shop. However, every time a customer swipes, taps, or pays online the business incurs a credit card processing fee.

These fees may seem small at first glance, but they can quickly add up and have a significant impact on your bottom line. Understanding the true cost of credit card processing helps business owners make smarter financial decisions choose the right payment processor and avoid unnecessary charges.

In this guide, we’ll break down how credit card processing works the different types of fees what affects their cost and how you can reduce them all in simple clear terms that every business owner can understand.

What Is Credit Card Processing?

Credit card processing is the system that allows businesses to accept payments made by credit or debit cards. It involves several steps from the moment a customer pays to when the funds are deposited into the merchant’s account.

When a customer makes a purchase, their payment information is securely transmitted through multiple parties:

- The Merchant – the business accepting the payment.

- The Payment Processor – the company that handles the transaction (like Stripe, PayPal, or Square).

- The Card Network – such as Visa, Mastercard, or American Express, which routes the transaction.

- The Issuing Bank – the bank that issued the customer’s card.

- The Acquiring Bank – the merchant’s bank that receives the funds.

Each of these players takes a small portion of the transaction as a fee which explains why credit card processing isn’t free.

Understanding how this process works is the first step toward managing costs effectively and ensuring your business gets the best possible rates.

How Credit Card Processing Fees Work

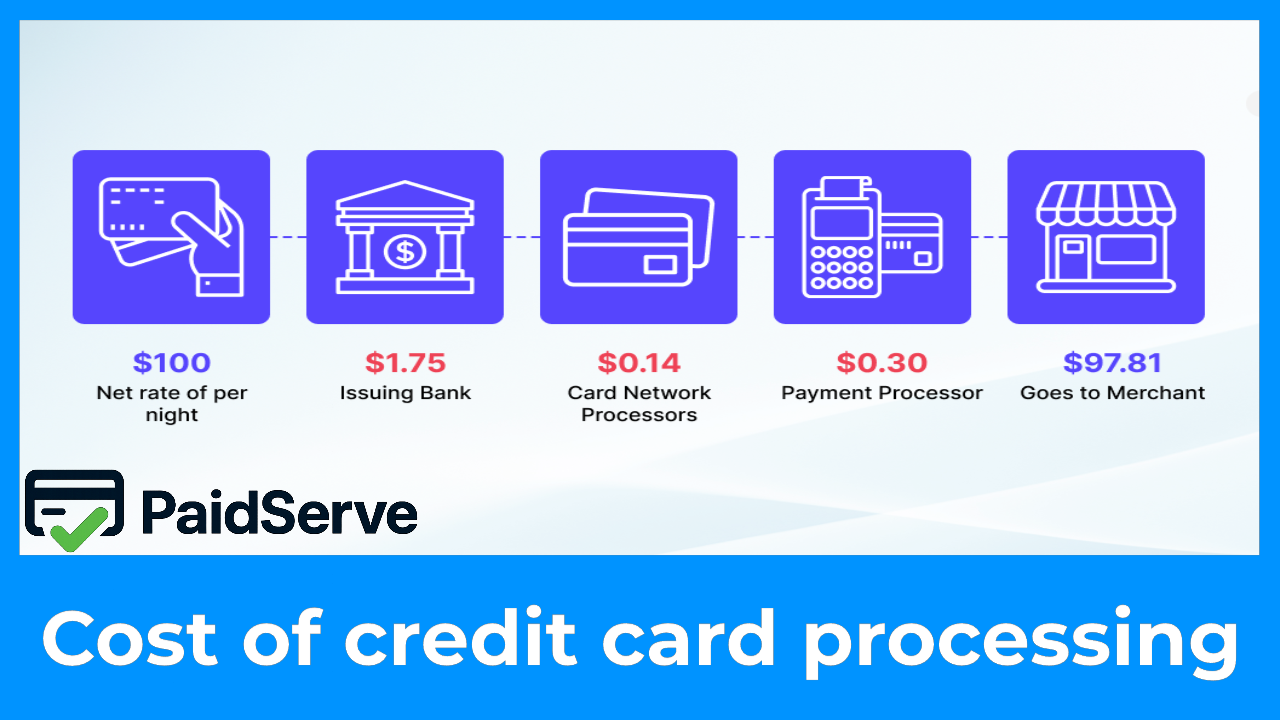

Every time a customer pays with a credit or debit card, the transaction goes through several steps and each step involves a small cost. These costs are what make up your credit card processing fees.

In simple terms, these fees are a percentage of each transaction (plus a small fixed fee) that payment processors and banks charge for moving money securely between accounts.

Here’s how it works:

- Transaction Occurs: A customer pays for a product or service using their card.

- Authorization: The card network (Visa, Mastercard, etc.) verifies the payment details and approves the transaction.

- Settlement: The issuing bank transfers the money to your acquiring bank, minus the applicable fees.

Typically, a credit card processing fee includes three main parts:

- Interchange Fee: Paid to the customer’s bank for handling the transaction.

- Assessment Fee: Paid to the card network (Visa, Mastercard, etc.).

- Processor Markup: Paid to the payment processor or merchant service provider for facilitating the payment.

Most businesses pay between 1.5% and 3.5% per transaction, depending on the type of card, the processor, and how the payment is made (in-person or online).

Understanding how these fees are structured is essential to control costs and ensure you’re not paying more than necessary.

Types of Credit Card Processing Fees

When you accept card payments several different types of fees come into play. Understanding each one helps you see where your money goes and where you might be able to save. Here are the main types of credit card processing fees every business should know:

1. Interchange Fees

These are the largest portion of your processing costs. Interchange fees are paid to the issuing bank (the customer’s bank) to cover the risk and cost of processing the transaction.

- Usually range between 1.5% – 3% of the transaction amount.

- Depend on factors like card type (credit vs. debit), transaction method (online or in-person), and industry type.

2. Assessment Fees

Assessment fees are paid to the card networks such as Visa, Mastercard, Discover, or American Express.

- They are usually a small percentage, around 0.13% – 0.15% of each transaction.

- These fees help the card networks maintain and operate their payment infrastructure.

3. Processor Markup Fees

This is the fee your payment processor or merchant service provider charges for managing the transaction.

- It may include a fixed fee (e.g., $0.10–$0.30 per transaction) plus a small percentage of the sale.

- The markup varies widely depending on your provider and plan.

4. Monthly or Hidden Fees

Some processors also charge additional costs, such as:

- Monthly account maintenance fees

- PCI compliance fees (for security standards)

- Statement or reporting fees

- Gateway fees (for online payment portals)

While these charges may seem small, they can add up quickly, especially for high-volume businesses.

By breaking down these fees, you can better evaluate offers from different processors and identify which ones are transparent and which might be hiding unnecessary costs.

Average Credit Card Processing Costs by Card Type

Not all credit cards cost the same to process. Some card networks charge higher interchange and assessment fees which means your total cost per transaction can vary. Here’s a quick overview of the average processing fees by card type:

| Card Type | Average Fee Range | Who Charges It | Typical Use Case |

| Visa | 1.4% – 2.5% | Card network + issuing bank | Most common, widely accepted |

| Mastercard | 1.5% – 2.6% | Card network + issuing bank | Reliable and widely used |

| Discover | 1.6% – 2.8% | Discover network | Popular with U.S. consumers |

| American Express (Amex) | 2.3% – 3.5% | Amex directly | Premium rewards cards, higher cost |

| Debit Cards | 0.5% – 1.5% | Issuing bank | Lower risk, lower cost |

| Corporate / Rewards Cards | 2.0% – 3.0% | Issuing bank + network | High-value transactions |

The more benefits a card offers the customer (like points, miles, or cashback), the higher the fee tends to be for the merchant. That’s because the issuing bank uses part of those fees to fund the rewards programs.

If you’re running a business, tracking which types of cards your customers use most can help you estimate your overall processing costs and negotiate better rates with your provider.

How to Reduce Credit Card Processing Fees

Credit card processing fees can quickly eat into your profits especially if you run a small business. Luckily, there are several smart strategies to lower your processing costs without sacrificing convenience for your customers.

1. Compare Multiple Payment Processors

Not all providers charge the same rates. Some specialize in small businesses, while others offer discounts for high transaction volumes. Before committing to a contract, compare interchange-plus vs. flat-rate pricing to find the most cost-effective option.

2. Encourage Debit or Cash Payments

Debit card transactions typically come with lower interchange fees than credit cards. You can gently encourage customers to pay by debit or even offer a small incentive for cash payments when appropriate.

3. Avoid Unnecessary Fees

Watch out for hidden charges like monthly minimums, PCI compliance fees, or statement fees. Always read the fine print of your merchant agreement and don’t be afraid to negotiate or switch providers if fees seem excessive.

4. Keep Chargebacks Low

Chargebacks not only hurt your revenue but also increase your processing risk profile. Maintain clear refund policies, provide detailed receipts, and respond quickly to customer disputes to avoid chargeback penalties.

5. Use an Address Verification Service (AVS)

Using AVS during online transactions helps verify the cardholder’s billing address. This reduces fraud and can lower your risk rating — which might qualify you for better processing rates.

6. Choose the Right Pricing Model

- Flat-rate pricing (e.g., Stripe or PayPal): Simple and predictable but often higher for large volumes.

- Interchange-plus pricing: Transparent and ideal for businesses processing higher monthly amounts.

- Subscription pricing: A monthly fee with very low transaction costs great for scaling businesses.

7. Regularly Review Your Statements

Fees can creep up over time. Review your merchant statements every few months to identify rate increases or unnecessary services you’re paying for. If you spot anything unusual, call your provider and request an adjustment.

Common Myths About Credit Card Processing Costs

Credit card processing can seem confusing and unfortunately, there are plenty of misconceptions that make it even harder for business owners to understand their true costs. Let’s clear up some of the biggest myths once and for all.

Myth #1: All Processors Charge the Same Fees

This is one of the most common misunderstandings. In reality, processing rates vary widely depending on your business type, sales volume, and average ticket size. Shopping around can save you hundreds or even thousands per year.

Myth #2: Flat-Rate Pricing Is Always Cheaper

Flat-rate plans (like PayPal or Square) are easy to understand, but they’re not always the most affordable. For small or low-volume businesses, they’re great. But for high-volume merchants, interchange-plus pricing often delivers lower overall costs.

Myth #3: You Can’t Negotiate Processing Fees

Many business owners assume that fees are fixed. The truth? You can negotiate, especially if your business processes consistent monthly transactions. Providers want your business so use that leverage.

Myth #4: Accepting Credit Cards Isn’t Worth It

Some small business owners believe that avoiding credit cards saves money. But in today’s digital world, customers expect flexibility. Accepting cards can actually increase sales and build trust even if it means paying a small fee.

Myth #5: Higher Fees Always Mean Better Service

Not necessarily. High fees don’t always equal better support or faster funding. Always evaluate a provider based on reliability, transparency, and customer reviews not just price.

FAQ: Cost of Credit Card Processing

What is the average cost of credit card processing?

On average, credit card processing fees range from 1.5% to 3.5% per transaction. The exact amount depends on the card type (Visa, Mastercard, Amex), your pricing model, and your payment processor’s markup.

Why are credit card processing fees so high?

Fees are high because several parties take a share including the issuing bank, card network, and payment processor. Each of them charges a small percentage to cover risks, fraud protection, and operational costs.

How can small businesses lower their processing costs?

Small businesses can lower costs by:

- Choosing interchange-plus pricing instead of flat-rate models.

- Negotiating rates with providers.

- Encouraging debit or cash payments.

- Reducing chargebacks and fraud risks.

Which credit card network is the cheapest to process?

Typically, Visa and Mastercard have the lowest processing fees, while American Express is the most expensive. However, your provider’s pricing model also plays a key role in the final cost.

Are credit card processing fees tax deductible?

Yes. For most businesses, processing fees are considered a business expense and can be deducted during tax filing. Always keep accurate records and consult your accountant for details.

Do processing fees differ for online vs. in-person payments?

Yes. Online (card-not-present) transactions usually cost more because they carry higher fraud risk. In-person (card-present) payments, verified by chip or tap, generally come with lower interchange rates.

Can I pass credit card fees to my customers?

In some regions, yes but it depends on local laws. This is called a surcharge or checkout fee. Before applying it, always check your state or country’s regulations to stay compliant.

Understanding the cost of credit card processing isn’t just about saving a few cents per transaction it’s about protecting your bottom line and making smarter business decisions.

Every fee matters. Whether it’s interchange, assessment, or markup, knowing where your money goes gives you control over your cash flow. And when you combine that knowledge with smart strategies like comparing processors, reducing chargebacks, and choosing the right pricing model you can cut unnecessary costs and maximize your profit margins.